The loss aversion bias

In life we make decisions with the objective of winning. One of the most recurrent cognitive biases in finance is derived from emotions such as fear, anxiety, regret and uncertainty: loss aversion.

Emotions are linked to decision-making and, if we go to the world of investment, it is natural that people seek to increase or, at least, not damage their assets.

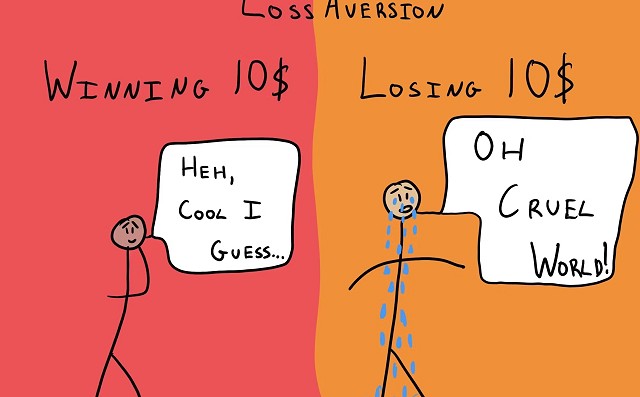

Aversion bias is the tendency that people have to take a loss into account more than a gain of the same magnitude. Even with equal amounts, for people the losses are greater than the gains. People like to win, but not nearly as much as we hate losing.

In 1981 , psychologists David Kahneman and Amos Tversky conducted an experiment they called “Decision Formulation and the Psychology of Choice.” With the same they calculated that a loss hurts us 2.5 times more than the enjoyment we experience from an equivalent gain.

Behind the fear of losses is the investor's fear of the possible negative consequences that their errors in the decision-making process may bring. The main consequence of this bias is that the investor tends to adopt an excessively conservative profile to avoid losses.

This leads you to incur an opportunity cost and the possibility of not achieving your objectives. For example, investing your money in checking accounts, deposits or even in investment funds that are excessively conservative for the time horizon of your investment and assuming a loss of purchasing power because the profitability that we can obtain in this type of vehicles rarely exceeds inflation.